Personal

Home & Auto Insurance

Protect yourself and your loved ones from risks on the road and at home

Get Home & Auto CoverageLife is full of surprises and replete with risk. When the unforeseeable happens, quality personal insurance coverage is a lifesaver (literally, sometimes). But, a string of bad fortune can turn things from bad to worse and the old adage rings especially true - when it rains it pours. In times like these, a personal umbrella coverage policy is a godsend.

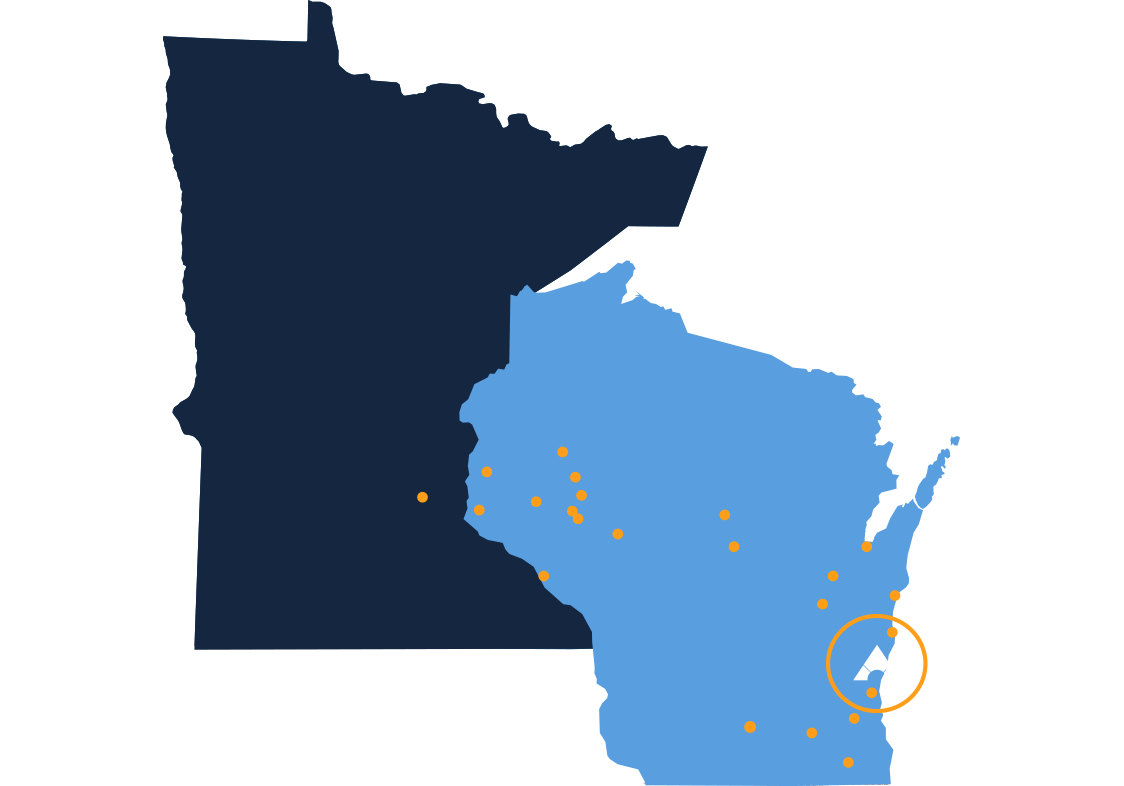

The insurance brokers at Ansay & Associates understand the need for people to get the coverage they need while staying within a reasonable budget; but occasionally those with high-value assets, high net worth, or owners of high-risk properties or businesses require the extra liability coverage that umbrella policies provide. The personal insurance agents at Ansay will work with anyone who needs this extra just-in-case protection and can help find the best umbrella coverage available for each unique client.

Service and experience sets us apart and it starts here.

Understanding Umbrella Policies

Umbrella insurance coverage is a type of additional insurance that provides extra liability coverage beyond existing personal insurance plans (NOTE: a person must hold standard coverage policies to be eligible for umbrella coverage). It kicks in when other personal coverages, like homeowner and auto insurance, have reached their maximum payout limit.

Umbrella coverage shields the policyholder from a wide range of risks above and beyond what’s covered by their existing policies. In this way, umbrella coverage is slightly different from excess liability insurance, which simply extends limits on the coverage you already have. Umbrella insurance policy coverage may include:

People covered

Every policy is different, but those covered by umbrella insurance may include:

What does it cover?

Umbrella coverage is typically associated with major claims - the most unexpected kind. For instance, a policyholder at fault in a car accident in which the other driver’s injuries require extensive medical care, plus expensive repairs to the both vehicles, may find their existing policies won’t cover the higher-than-expected costs. Without an umbrella coverage policy in place, the at-fault party will need to pay out of pocket or may face further legal risk (the costs of which can be covered by an umbrella policy).

How much is Umbrella Coverage?

When it comes to the cost of umbrella insurance, it may be more affordable than you think.

The cost of a personal umbrella policy typically lands in the range of $150 to $400 per year for a $1 million policy. Of course, the exact cost can vary depending on several factors, so it’s always best to reach out to a professional to learn more.

Why get more coverage?

There are many reasons to add umbrella coverage to your personal insurance policy. Some benefits of having umbrella insurance coverage include:

What do I need first?

There are several insurance types that a policyholder should have before getting umbrella coverage extensions:

Personal

Protect yourself and your loved ones from risks on the road and at home

Get Home & Auto CoveragePersonal & Business

Protect yourself or your business with general liability insurance coverage to help with damages and medical costs

General Liability Coverage InfoPersonal

Renters seeking umbrella coverage are required to have a renters insurance policy in place

Get info on Renters InsuranceChoosing Ansay & Associates as your insurance broker means working with a partner that values your peace of mind as much as you do. Don't wait for the flood of claims and costs to reach your door; invest in an umbrella policy today and protect your future. You can't predict the weather, but with Ansay & Associates, you can prepare for it.

Contact our team to get coverage that goes above and beyond your traditional insurance, and keep more of what you earned in the event of a worst-case scenario.

Contact Us

Please note, your message does not bind, alter, or cancel coverages and is not effective until confirmed directly with a licensed agent.

You Can Always Call Us Toll-Free at: 1 (888) 262-6729