Market Conditions Report

In a normal hard insurance market, available capital to insurers drives supply. If supply exceeds demand, prices drop. This year, however, has been anything but a normal hard market. In fact, there is plenty of capital available. Why? The answer, according to some experts, are carriers’ laserlike focus on profitability.

Manmade and natural catastrophes are near historic highs, with 2019 the fourth costliest year in history, according to Aon Global Chief Broking Officer Hugo Wegbrans. That means carrier profitability is now in the danger zone. Additionally, social inflation is also driving losses, with the impacts of COVID-19 making carriers particularly skittish pending the pandemic’s effect on business operations. As a result, carriers are looking for profit over growth.

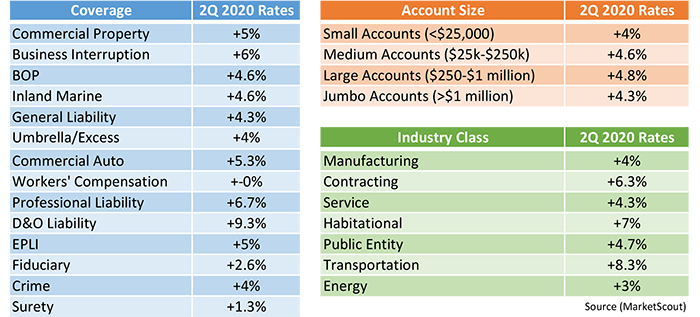

Almost all U.S. insurers are assessing rate increases, says MarketScout CEO Richard Kerr. According to Kerr, Surplus lines insurers are more aggressive with their rate increases for the second quarter of 2020, with rates up 9 percent. Other notables include D&O Rates up 9.3 percent while business interruption rates were up from 4 percent in Q1 to 6 percent in Q2.

The solution, according to Wegbrans, is for carriers is not to wait until the last minute to secure renewals. Being ready to defend or explain risks is paramount. And while relationships are valuable, they’re not the be-all, end-all in the market. Don’t wait for the last few days to secure a renewal, because that’s when other insurers poach clients.

Below, we take a look at how various sectors are being impacted by rapidly changing market conditions, followed by our analysis of the market conditions.

TRANSPORTATION

In recent years, the transportation sector has been beset by poor infrastructure, reduced freight demand, an aging workforce and a driver shortage. Additionally, inadequate pricing led to premiums that have not kept up with losses for the last several years. As a result, premium rates have continued to climb. Already operating on thin profit margins, transportation clients are always continuing to look for ways to maintain profits. All of this was happening before COVID-19 struck.

How is the trucking industry responding to this additional disruption?

Insurance carriers are allowing adjustments to better position their transportation clients to survive and thrive through disruptive economic uncertainty. Those adjustments include: Granting premium reductions, deleting units, and waiving monthly minimums for receipts, mileage, or units.

That said, there is much unknown in these unprecedented times. With fewer cars and less congestion on the roads, it remains to be seen what the impact will be on losses, and ultimately, rates. It’s also an opportunity for insurance carriers to right themselves after struggling with losses in recent times.

The high unemployment rate is also an opportunity for trucking companies to fill the driver shortage.

Now, more than ever, it’s important to work with someone who is dedicated to the complex, intricate and always-changing transportation market. Clients need someone who truly understands all the exposures in this specific niche.

COMMERCIAL

Commercial insurance prices continue to skyrocket. In fact, we saw prices surge 19% in the 2Q of 2020 – marking the 11th straight quarter they’ve risen. The recent increase was the largest since 2012, and follows increases of 14% in the first quarter and 11% in the fourth quarter of 2019. Increases are being driven by property insurance rates, as well as financial and professional lines.

This isn’t just a U.S. issue either – it’s worldwide. Double-digit increases were seen across the UK, Continental Europe and the Pacific.

A report by the Global Insurance Market Index put these figures into important context: “Underwriters continue to push for higher levels of pricing increases due to the combined effects of social inflation pressures, persistently low yields, and a number of large underwriting losses, including from COVID 19.”

There isn’t much relief in sight. Dean Klisura, president of Global Placement and Advisory at Marsh, believes these increases will continue.

“As insurers continue to work through claims in property and directors and officers, and with the full cost of COVID-19 still developing, upward pressure on pricing is anticipated for the balance of 2020,” Klisura said.

CLASS ACTION

Settlement amounts for just the largest 10 class actions of 2020 equal $3.8 billion. The entire 2019 figures is at $3.1 billion. This is leading to large pricing increases of 250% or more.

CYBER

Cyber had been flat up until this year. But an explosion in ransomware is impacting middle market clients in a big way. This is likely to be the next market to harden, according to Aon, with rate increases on primary cover of 5-10% and on excess layers of 20% or more.

CASUALTY

Nick Gillet, Aon’s Chief Broking Officer, said that changes are unpacking 15 years of the soft market in terms of coverage, scope, pricing, and deductibles.

“General market increases of 10-25% are being seen across primary and first layer placements,” Gillet said. Capacity reductions and withdrawals are possible in sectors like wildfire, mining, energy and the public sector.

CORONAVIRUS EFFECTS

In a case closely followed by insurance industry experts, a federal judge in Missouri rules that a group of hair salons and restaurants could sue their insurance carriers for business interruption losses caused by the coronavirus pandemic, saying it caused a “direct physical loss” to their premises. The decision went against Cincinnati Insurance Co. in August, and appears to be the first victory for policyholders suing insurers for improperly denying claims related to COVID-19 shutdowns.

Business owners have filed hundreds of lawsuits claiming their business interruption insurance, typically used for coverage of fires or floods should also cover a pandemic, according to the DailyNewsflash. Insurance carriers have countered by arguing applying such coverage to COVID-19 losses would result in business-crippling payouts.

ANSAY & ASSOCIATES ANALYSIS

At Ansay we most certainly have been experiencing premium increases for our property and casualty customers. Many carriers have concentrated the increases on commercial property and commercial auto; with an emphasis on classes of business that typically have high risk.

Our licensed and trained risk managers and insurance advisors have all the latest innovations to help our clients control their premium costs. In addition, our long term relationships with the top insurance carriers in the country allow us to provide the best possible products, service, and price to our clients and prospective clients.

Almost there!

We need a little more information from you. Once this form is submitted you will be able to utilize the resource requested.

By requesting this resource, you are agreeing to receive email communications from Ansay. You can unsubscribe at anytime via your preference center.

Not allowed

You are attempting to download a resource that isn’t available to you.