Common Insurance Claims in the Summer & How to Protect Yourself

As much as Wisconsinites love winter (sort of, it’s complicated) and all its charms, the emergence of summer is a welcome change when it eventually comes. Warm weather brings baseball games, barbecues, road trips, pool parties, boats, motorcycles…and people really let loose, shedding coats and boots for shorts and sandals.

Unfortunately summer revelry brings a wide variety of risks to personal property, health, and added liability in a range of circumstances that only summer allows for. Fortunately Ansay & Associates’ team of insurance advisors have solutions that reduce your risk exposure and help keep you and your family safe, happy and having fun.

Auto Insurance for Summer Driving

Summer is the most dangerous time for motorists: there are more people on the road, people drive longer distances, inexperienced teen drivers are distracted and on summer break, and dry road conditions encourage bad actors to drive faster and more recklessly. All this accounts for a near 30% increase in road deaths during the summer months.

The auto insurance brokers at Ansay are in your corner to make sure you have the appropriate auto coverage to fit your needs and keep you and your family safe from the fallout following an auto crash. Whether a minor fender bender cost more than you expected to repair, or you (or a passenger) was injured in an accident, we’ll be sure you have the coverage you need to absorb the damages with as little financial impact as possible.

Motorcycle Insurance

Come the month of May in Wisconsin you can’t help but hear mufflers rumbling as if emerging from hibernation: bikers are stretching their legs and hungry for the open road. An unfortunate side effect of long winters is that even normally good drivers can become lax in their attentiveness to motorcycles on the road. For motorcyclists, that’s not enough to keep them from riding, so they need good protection when they’re chewing up the pavement.

Whether your iron horse is a moped, a sport bike, enduro or a Harley-style cruiser, bikers in WI have a unique need for good motorcycle insurance coverage. This may mean simple liability coverage, or a more comprehensive plan that covers repairs, or even total loss and personal medical costs resulting from a wreck. Ansay’s team will find the right insurance for any rider (and even their passengers) in any circumstance.

Boat Insurance

When Wisconsinites trade in their ice shanties for bass boats and their augers for water skis, the good times are sure to keep rolling on lakes and lake shores. However, boat ownership and lake life in general come with some serious risks. The WI DNR reported 20 boating fatalities in 2022 and nearly 100 reported boating accidents requiring $2000 worth of repairs or more. It’s no wonder boaters are recommended to have liability insurance to operate on the water. The insurance advisors at Ansay & Associates will get you the coverage you need to mitigate the risks inherent in water recreation.

The old joke is that boats are a hole in the water where you throw your money… they are expensive to own and maintain. It’s essential to guard against the high costs of damage, of course. Boat owners will be relieved to know that the experts at Ansay will find them the best in collision or comprehensive boating insurance. The two happiest days of a boat owner's life are when they buy the boat, and when they sell it. For all those summers inbetween, Ansay has you covered.

RV & Camper Insurance

Nothing like taking a home with you on those classic summer road trips! RV owners love this time of year to get out and explore, and for those new RV owners, there’s nothing like planning and taking that first big excursion. But just like owning a home, you quickly start to realize that there’s a lot of financial responsibility required in RV or camper ownership—and a lot of liability involved. Whether it’s water damage from long winter storage, expensive & difficult repairs in the case of a breakdown, or simple restitution for damages incurred when parking, towing, or driving your RV, it all can add up.

Ansay & Associates will help you stay protected while you live the nomadic life in your motorhome. Our team of experienced insurance advisors know the ins and outs of making sure RV owners have the insurance they need. We’ll help you navigate the web of required coverage that can vary from state to state, and provide you with great options to make sure your investment in a motorhome doesn’t break the bank in case the worst happens.

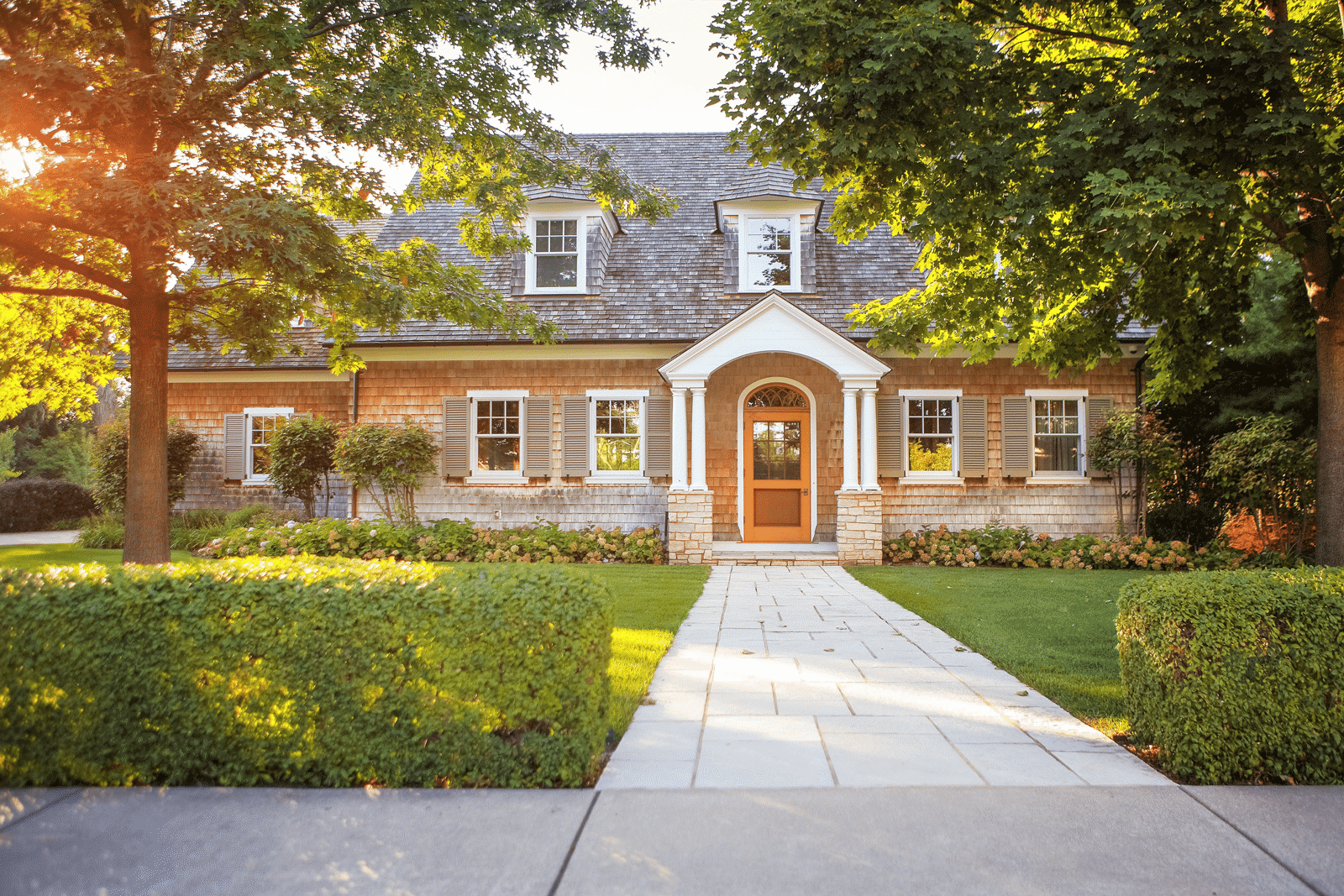

Home Insurance for the Summer

People own homes throughout the year, so why do we need to discuss home insurance specifically for the summer? The answer is: because you need to make sure you’re covered against the changing risks that summer brings. When warm weather finally hits Wisconsin, a lot can change. Floods, for example, become a bigger threat as the ground thaws and the ice melts. Extreme weather like tornadoes and severe thunderstorms can damage even well-insured homes to the point of catastrophe. The liability of open pools, cookouts, 4th of July parties, yard sales, the increased risk of fire… all of these and more are compelling reasons to rethink your home insurance coverage before summer.

Ansay & Associates helps homeowners find the insurance they need every day. Our expert advisors are pros at examining risks and providing the coverage required to reduce them, often discovering solutions to risks that homeowners didn’t even know they were exposed to. Did you know home burglaries are much more common during the summer months? Our team did. Did you think about the risks to your new deck you installed last summer beneath the shady old oak tree? Our team will. Whether you need umbrella coverage, or just want to know what liabilities you’re exposed to when converting that summer cabin to an AirBnB, we’ll point you in the right direction.

We're here to answer your questions. Let's talk.

Contact Ansay for all the coverage you need over the summer and beyond!

You Can Always Call Us Toll-Free at: 1 (888) 262-6729

Almost there!

We need a little more information from you. Once this form is submitted you will be able to utilize the resource requested.

By requesting this resource, you are agreeing to receive email communications from Ansay. You can unsubscribe at anytime via your preference center.

Not allowed

You are attempting to download a resource that isn’t available to you.