Product liability insurance

This type of insurance protects your business if a product you have manufactured causes injury or damage.

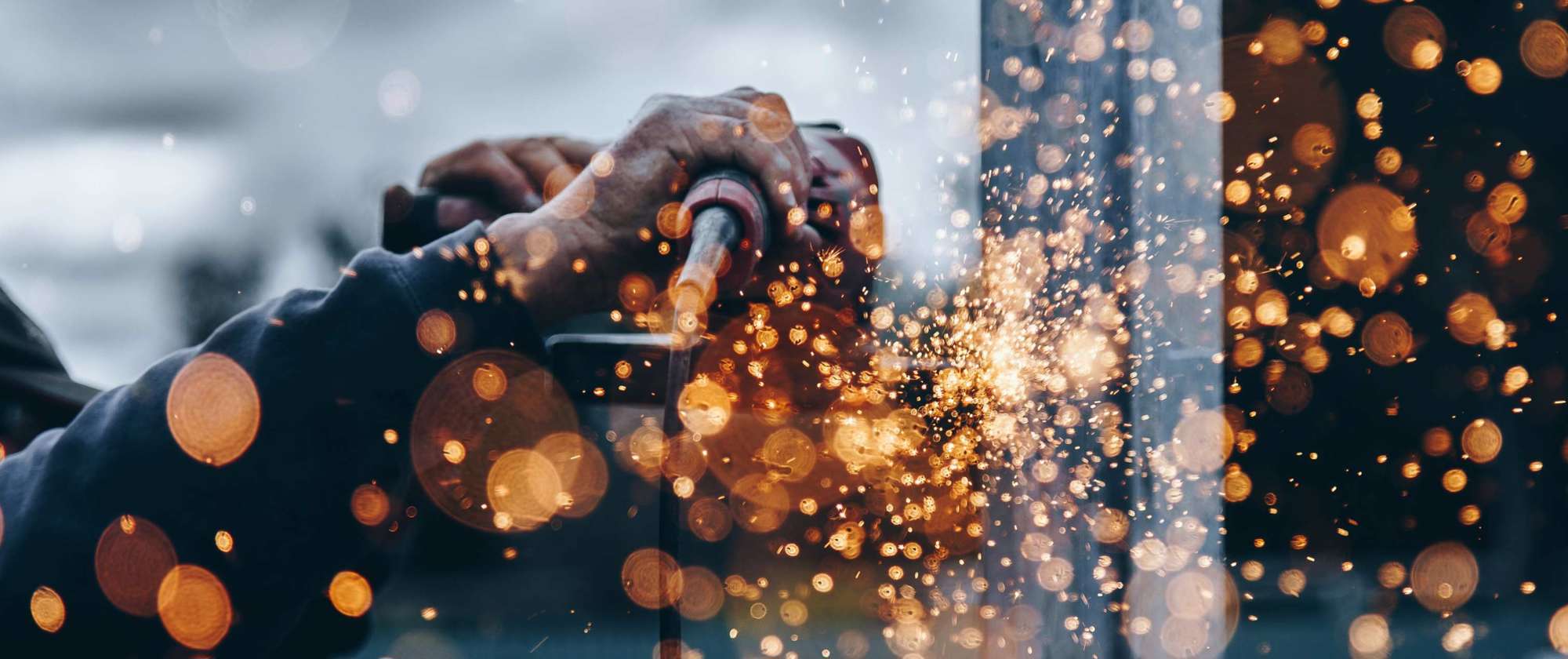

Manufacturing insurance is an important safety net for any business that manufactures goods and products. Manufacturers insurance protects the business from liability and loss. In the event of an accident, product defect, or other issue, this type of insurance can help cover the costs associated with potential lawsuits, medical bills, loss to the business and more.

This type of insurance protects your business if a product you have manufactured causes injury or damage.

This type of insurance can help with the costs of recalling a defective product.

This type of insurance can help cover lost income and expenses if your manufacturing business is interrupted due to a covered loss.

This type of insurance protects your manufacturing facility, equipment and inventory in the event of a covered loss.

This type of insurance can help with costs related to environmental cleanup and third-party bodily injury or property damage claims if your manufacturing business causes pollution.

This type of insurance is required in most states if you have employees. It can help cover medical expenses and lost wages for employees injured on the job.

This type of insurance can provide additional liability coverage above the limits of your other business insurance policies.

This type of insurance can help cover the costs of damages caused by a company-owned vehicle.

This type of insurance can help cover the cost of damages to goods in transit.

Ansay Tips

The following attributes are drivers in determining the amount of coverage you need and the cost of the coverage:

Ansay's specialized manufacturing insurance advisors will help you determine the types of coverage you need and the appropriate limits of liability.

View the Advisor Directory

Workers’ compensation can help cover medical costs and even provide employee wages for time missed from work and is an important thing to have as a business owner. Learn more about workers’ compensation insurance coverage options.

Explore Workers CompensationAccidents happen and if they happen on your property or as the result of work that you have done, you could be liable for damages. Learn more about general liability insurance options.

Explore General LiabilityIf a company vehicle is involved in an accident, your business will only be protected with the right commercial auto insurance coverage. Learn more about business auto insurance.

Explore Business Auto